Browse Products by Sector

Container ShippingContainer Equipment Assets

Ports and Terminals

Dry Bulk Shipping

Tanker Shipping

Gas Shipping

Specialised Shipping

Multimodal Transport

Logistics Management

Ship Operations and Management

Other popular areas

Browse subscriptions by Sector

Container ShippingPorts and Terminals

Dry Bulk Shipping

LPG Shipping

LNG Shipping

Crude Tanker Shipping

Product Tanker Shipping

Financial Advisory

Valuations

Drewry Financial Research Services Ltd is authorised by the UK Financial Conduct Authority (FCA).

Supply Chain Advisors

Cancelled Sailings Tracker - 26 Apr

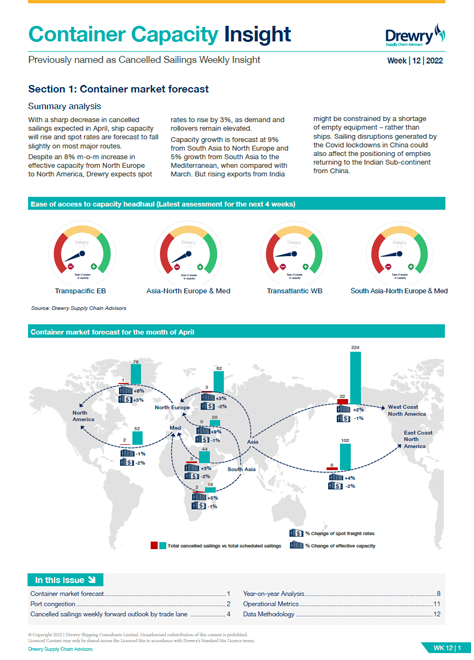

Our weekly Cancelled Sailings Tracker provides a snapshot of blank sailings announced by each Alliance versus the total number of scheduled sailings.

Further to the snapshot below, you may be interested in an annual subscription to our Container Capacity Weekly Insight which provides detailed assessments and analysis by main trade and alliance. Weekly reports include port waiting time events for Los Angeles and Long Beach, and year-on-year comparison.

Weekly analysis: 26 Apr 2024

Across the major East-West headhaul trades: Transpacific, Transatlantic and Asia-North Europe & Med, 47 cancelled sailings have been announced between week 18 (29 Apr-5 May) and week 22 (27 May-2 Jun), out of a total of 643 scheduled sailings, representing 7% cancellation rate.

During this period, 49% of the blank sailings will occur on the Transpacific Eastbound, 34% on the Asia-North Europe and Med and 17% on the Transatlantic Westbound trade.

Over the next five weeks, OCEAN Alliance have announced 16 cancellations, followed by THE Alliance and 2M with 12 and 5 cancellations, respectively. During the same period, 14 blank sailings have been implemented by non-Alliance services.

As can be seen in the chart above, on average 93% of the ships are expected to sail as scheduled, over the next five weeks.

On the ocean freight side, Drewry’s Composite Freight Index contracted marginally, 0.5% WoW to $2,706. This week, transpacific rates dropped 3%, while Transatlantic rates were down by 3%, conversely rates on Asia-Europe and Med routes were up by 2%.

The Middle East faces heightened risk of conflict after Iran’s April 13 strike on Israel. Closure of the Strait of Hormuz would disrupt shipping, leading to increased costs for carriers and global economic repercussions, including higher energy prices and inflation, potentially reducing demand for containerized goods.

For ports inside the Gulf, this may lead to the transfer of some transhipment volumes to hubs which are deemed safer or to the loss of gateway cargo to alternative ports, such as Khor Fakkan and Sohar or Salalah” plus longer lead time for shippers.

Drewry believes escalating tensions may cause cost hikes, supply chain issues, shipping congestion, and reduced Gulf exports.

Worth knowing...

We provide a comprehensive range of research and advisory service support to international shippers, from contract advice, freight rate forecasts and surcharge insights to help mitigate the commercial challenges exacerbated by the ongoing crisis in the Red Sea.

Solutions for shippers/BCOs

Introduction to our Container Capacity Insight (annual subscription)

Find out more

Related Indices

World Container Index: Our detailed weekly analysis and latest freight rate assessments for eight major East-West trades.

World Container Index Index

IMO 2020 BAF Tracker: We’ve introduced a simple, clear indexing mechanism to help determine changes in the BAF charges during the lifetime of a contract.

Low Sulphur Bunker Price Index

Global Port Throughput: Every month we publish global Port Throughput Indices - a series of volume growth/decline indices based on monthly throughput data for a sample of over 220 ports worldwide.

Drewry Port Throughput Index

Working with 3 of the top 10 global retailers (National Retail Federation)

Access to an exclusive ocean freight cost benchmarking club comparing costs on over 14 million teu of freight

The first to publish benchmark container spot market freight rates back in 2006.

Related Maritime Research

Track the spot market

Keep up to date with the movements of container spot market freight rates with our popular Container Freight Rate Insight service.Benchmark contract rates

Join our exclusive Benchmarking Club and find out how your contract rates compare to your peers.Monitor your carrier

Understand how your carriers are performing with our online Carrier Performance Insight service.

Container Capacity Insight (Annual Subscription)

Weekly Insights · Latest release 01 Mar 2024

Learn more

View more

© Copyright 2024 | Drewry Shipping Consultants Limited. All Rights Reserved. Website Terms of Use | Privacy Policy